The Total Beginner’s Guide to Cryptocurrency Trading Bitcoin, Ether and More

Contents:

When a lot of these cryptocurrency markets were first listed a lot of the price action charts had extremely minimal price action information. Investing in cryptocurrencies, Decentralized Finance , and other Initial Coin Offerings is highly risky and speculative, and the markets can be extremely volatile. Consult with a qualified professional before making any financial decisions. This article is not a recommendation by Investopedia or the writer to invest in cryptocurrencies nor can the accuracy or timeliness of the information be guaranteed. The first cryptocurrency to be created was bitcoin in 2008 by a mysterious person or group going by the name Satoshi Nakamoto. Bitcoin’s introduction was only the beginning of an influx of a myriad of cryptocurrencies, all launched with the aim of replacing bitcoin.

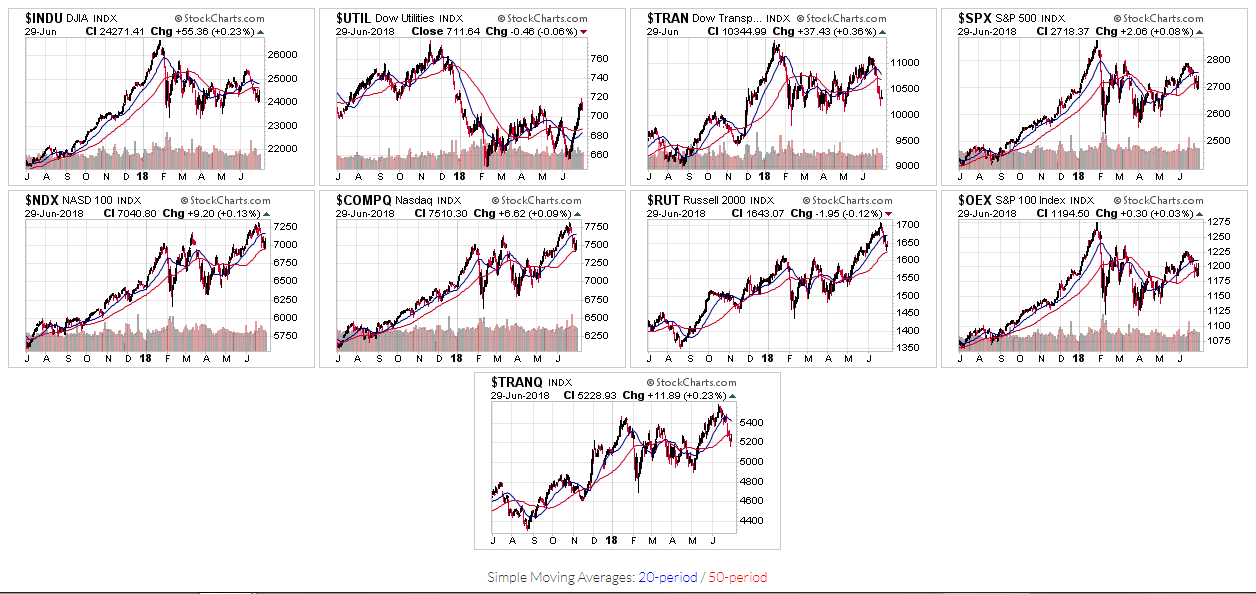

The important thing is that it will establish some clear guidelines and goals, and it will keep you from making emotional trades or trades based on your “gut feeling”. More advanced technical analysis indicators include the relative strength index , moving average convergence divergence , Bollinger Bands, Fibonacci Retracements, and others. Some of the most popular trading methodologies include a number of these indicators. These methodologies include Dow Theory, Elliott Wave Theory, and the Wyckoff Method. When it comes to performing fundamental analysis on cryptocurrencies the analysis will include the emerging field of on-chain metrics. This includes the number of holders, the top holders, how many addresses are on-chain, the growth of the blockchain, hash rate, and many other metrics.

There will be countless other software changes across all cryptocurrencies, so make sure that you understand the implications of those changes. There are many things that can affect the price of a cryptocurrency…sometimes very quickly. Let’s say that a hacker gets into your bank’s computer tomorrow and transfers all of your money to his account, then deletes any trace of the transaction.

Chapter 4 – Technical Analysis Basics

Instead, you’re better served considering overall fees and any discounts available for trading a certain amount each month or holding an exchange’s native cryptocurrency. Thanks to its simple, easy-to-use interface, we found Gemini to be the best crypto exchange for beginners. Note that the platform’s slightly higher fees are worth paying in exchange for convenience and ease of use. What a lot of people do not realize is that both Foreign exchange and crypto markets do not sleep or stop trading ever.

Crypto Boom Review: Is This the Future of Cryptocurrency Trading … – Fairpress

Crypto Boom Review: Is This the Future of Cryptocurrency Trading ….

Posted: Sun, 02 Apr 2023 14:59:52 GMT [source]

Crypto trading courses will outline cryptocurrency’s fundamentals and provide proven strategies. The article has outlined various crypto trading courses you can go through and choose the one that suits you best. Copy Trading is built on trust and it has its advantages in the digital currency ecosystem. One of these is that newcomers are shielded from dealing with the extreme volatilities of cryptocurrencies.

Ultimately, they offer the ability to transfer money securely without paying hefty bank charges and waiting days for funds to clear. First launched in 2015, Ethereum has become one of the top crypto currencies. Perhaps piggybacking on the success of Bitcoin, many people sought out newer digital currencies for cryptocurrency investing in the hope that they would increase in value too.

How are cryptocurrencies created?

For example, many cryptocurrency exchanges also provide users with a wallet feature. In most jurisdictions cryptocurrencies are now considered to be taxable assets, and there are tax implications for trading cryptocurrencies. For one thing, different coins aren’t necessarily considered to be “like-king assets”, which can lead to surprises when you file your taxes. Thankfully there are now crypto tax services that track your crypto gains and losses from trading and help you with your tax filing.

Just like with crypto exchange fees, if tax is not accounted for, it can lower your profits. It’s hard to talk about crypto trading without talking about risk management in cryptocurrency trading. Risk in crypto trading refers to the chance of an undesirable outcome happening. To better understand leverage, assume you enter a trade with 5x leverage. This means that your trade’s position size is 5 times the capital you staked from your own pocket (i.e., margin).

Trading involves risk and can result in the loss of your investment. All information on this site is for informational purposes only and is not trading, investment, tax or health advice. The reader bears responsibility for his/her own investment research and decisions. Seek the advice of a qualified finance professional before making any investment and do your own research to understand all risks before investing or trading. TrueLiving Media LLC and Hugh Kimura accept no liability whatsoever for any direct or consequential loss arising from any use of this information. So in this post, I want to share with you my knowledge of the cryptocurrency markets and give you a total beginner’s guide to trading them.

The compensation that miners receive for successfully validating new transactions and recording them on the blockchain. Be aware of current trends in government regulation and steer clear of currencies that could get red flagged by government agencies. One example is in Venezuela, where the police have been arresting Bitcoin minerson made-up charges. This has forced miners to go underground or start mining Ether instead. Finally, government regulation can have a huge effect on the value of a cryptocurrency. This is where storage becomes an important part of the cryptocurrency valuation equation.

Cryptowatch: Cross-Exchange Trading Terminal

This https://coinbreakingnews.info/ makes it easy to buy and sell with the Kraken Instant Buy platform. More advanced users can take advantage of lower fees with Kraken Pro, which charges a 0.16% maker fee and a 0.26% take fees for trades of $50,000 or less. In addition, Gemini offers an extensive selection of educational materials in its Cryptopedia library. Users can read up on a whole host of crypto topics, from advanced crypto trading strategies to understanding the latest developments in decentralized finance . Very similar to trading Forex, it is recommended you consider all your options and your trading strategy and goals before holding trades over the weekend. Whilst in Forex longer term positions can sometimes be viable, in a market where there can be huge percentage point swings, holding positions over the weekend can be very risky.

This way, cryptocurrency trading basicsrs can speculate on the price of the underlying asset without having to worry about expiration. This will usually incur a variable interest rate , as the rate is determined by an open marketplace. As you’d imagine, hindsight bias can have a significant impact on the process of identifying market trends and making trading decisions. Confluence traders combine multiple strategies into one that harnesses benefits from all of them.

Use leverage with EXTREME caution on these products which is why I discuss risk management below. It can also be used to protect you from loss if you use smartly as we will discuss. If you think price is going to go up you can make profits from a price rise and you can also take advantage from price making a price plummet lower by short selling. This gives you the chance to gain exposure to the price of the Cryptocurrency without actually having to store it or worry about the counterparty risk from the exchange.

FTX struggled to deal with liquidity issues amid a spike in withdrawals. As the fallout spread, cryptocurrencies both large and small saw their values plummet. In the legacy markets, people found guilty of facilitating pump and dump schemes are subject to hefty fines. You do this for each individual trade, based on the specifics of the trade idea.

Then we make sure you are using cryptography to secure your cryptocurrency. Some price tools may be difficult to use, but attaining proficiency in some takes time. By pitching your tent with iMi Academy, we will show you how to utilize these tools, and how you can use them to assess projects, exchanges, and trends to your advantage. The unique smart contracts that have made Ethereum their homes and the price actions of their respective native token. It is also important before diving into Ethereum trading about the impact of transaction fees.

Cryptocurrency mining or staking is a great way to get involved in cryptocurrencies. They’re convenient for sure, but you do pay for that convenience. You’ll also want to have an external wallet to transfer your cryptocurrencies to when done trading. For the highest level of safety we always recommend choosing a hardware wallet like the Ledger, Trezor, or Opolo. Other options for wallets include desktop wallets like the Exodus, or online wallets such as MetaMask.

However, cryptocurrency values have made them popular as trading and investing instruments. To a limited extent, they are also used for cross-border transfers. In this guide, you will learn everything you need tostart trading cryptocurrencies. Once you end reading our guide,you will have all the background informationon buying and selling digital assets.

Cryptocurrency For Beginners: Use A Cryptocurrency Wallet

If all you know about crypto trading is the above, you know enough to get started trading cryptocurrency. For example, Atomic Wallet, MetaMask, Trezor, or even the wallets offered on exchanges. Kraken is a US-based exchange that offers trading in US dollars, Canadian dollars, Euros, British pounds, and Japanese yen. They pay special attention to their security with a track record of 0 breaches. Kraken also has an extensive list of crypto assets and covers over 70 of them.

- The scoring formula for online brokers and robo-advisors takes into account over 15 factors, including account fees and minimums, investment choices, customer support and mobile app capabilities.

- He encouraged those starting in the crypto space to register their crypto in the spirit of getting ahead because “It’s far less costly to do so from the outset.”

- Students also get the “Cryptocurrency Exchange Starter Guide,” a downloadable PDF that teaches students how to trade cryptocurrencies even faster.

- The blockchain behind CryptoCurrencies can make Gmail obsolete as well.

- And, as with most other investments, if you reap capital gains selling or trading cryptocurrencies, the government wants a piece of the profits.

Learn how to separate the scams from the deeply underpriced currencies. This is a perfect example of the benefit of staying in touch with other traders on platforms like Twitter. Exchanges How to Withdraw Buying Power From Robinhood Learn how to withdraw buying power from robinhood, and trade on other services.

- One common way cryptocurrencies are created is through a process known as mining, which is used by Bitcoin.

- Investors might also come across the Grayscale Bitcoin Investment Trust , an open-ended trust.

- The exchange also supports transaction scheduling to reduce the impact of price volatility.

- These various order types can help protect you from the inherent volatility of the crypto markets.

Almost everyone is trading, and there is a human tendency to do what everyone else is doing. There is a version of trading in crypto known as day trading which is more like the stock market in traditional finance. If you decide to participate in day trading, watch out for fear of missing out, also known as FOMO, as it is the fastest way to lose money.